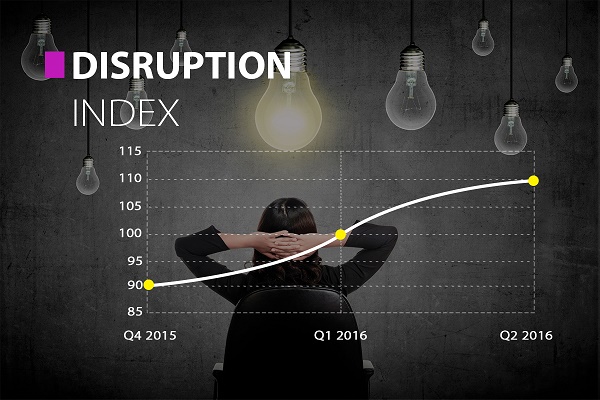

The Disruption Index tracks change in the bookkeeping services sector, and the broader accounting eco system of suppliers, vendors and app developers. Accounting and bookkeeping services are undergoing disruptive change thanks to a rapid adoption by small business customers of digital solutions offered by accounting software providers, disintegrating time-based business models and a changing competitive landscape.

Clients are looking for collaboration, more real-time data, less paper to manage, and business intelligence they can use (and understand!). Whereas just a few years ago, bookkeepers had a clear, narrow brief and soldiered on. Today, it’s about connecting with an ever-expanding eco system of app developers, industry experts, as well as threats from direct action by accounting software vendors, accounting firms and a breed of tech savvy, dynamic Next-Gen business owners who demand real –time interaction and low-cost solutions.

Industry is driving change in business models for bookkeepers, providing dramatic improvements for how small businesses operate, communicate and manage their customer relationships. .

Forward-thinking bookkeeping business owners are embracing change. It’s for those that seek to find what’s next and want insights on key technology trends, that the Disruption Index is built.

Main Elements

Competiveness in the landscape: Business owners are increasingly aware of solutions available to them from a highly competitive supplier landscape resulting in an increased focus on value expectations from their accountants and bookkeepers. Further, so-named ‘outsourced solutions’ are gaining market share.

Service expectation. Business owners are demanding cost effective solutions. Value of basic bookkeeping has continued to collapse, highlighting the small business sector’s increasing awareness of alternatives in the market.

Analysis of data. Small business has a preparedness to provide electronic access to private information, most notably in the form of bank and accounting data fees. This is increasing quarter on quarter, on the recognition that it is necessary to ensure timely reporting for both compliance and management of business finances.

Pricing pressures. Conventional pricing is being trumped by pricing options built on new business models such as fixed price quotes and monthly subscription plan. An irreversible trend for the bookkeeping profession is the move away from hourly rate billing.

Packaged services. Another irreversible trend is that of positioning from ‘accounting technician’ to ‘trusted advisor’ on the back of creative service packages. Integration capability is becoming a high value competency.

Disruption forces traditional participants to change

Bookkeeping business owners face pricing and business model pressures, indeed with the barriers to entry for (data) analysis capability dropping precipitously, there is an imperative to add new skills sets in their business.

Small business no longer accepts less than technology-driven services. SaaS is removing the need of paperwork and face-to face meetings with the bookkeeper. Productivity gains are there to be taken for the nimble-footed professional services firm. Best practice has moved away from a reliance only on technical proficiency towards new metrics such as optimising client: bookkeeper ratios and revenue yield per client.

What is the Disruption Index?

The accounting and bookkeeping sectors are undoing disruptive change, thanks to business clients demanding technology-driven solutions at affordable prices and a vendor-led investment in technology and marketing.

The Disruption Index tracks the impacts of disruption from both the small business sector, the supplier-vendor industry sector and the professional services firms – accounting, bookkeeping – and the education sectors. The index tracks the dimensions listed above as well as information derived from quarterly interviews of a sampling of professional services firms (sole practitioner bookkeepers, accounting firm partners and bookkeeping business owners).