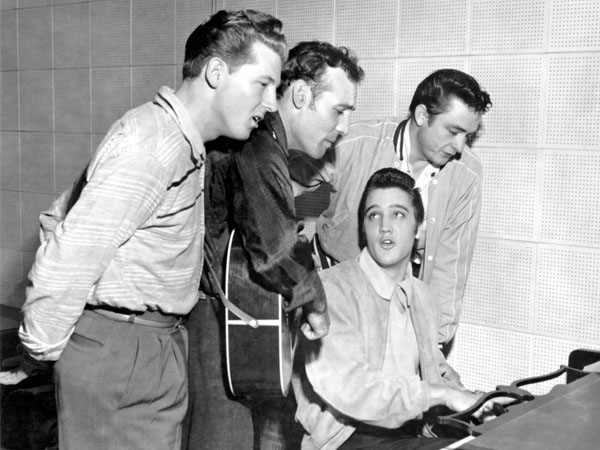

It is a paradox that Bookkeeping is rated #1 as “The Most Profitable Industry* in the USA” and yet bookkeepers in the US and in Australia/NZ struggle to earn an income comparable to other service professionals. Then again, artists like musicians struggle to earn a living wage unless their name is Elvis Presley or Keith Richards etc. So how do you become a rockstar bookkeeper?

A massive potential

A study by financial information company *Sageworks, revealed that Bookkeeping firms achieved a net profit margin of 19.6% beating – surprisingly – ‘Legal Services’ firms and many other industry groups.

Given we have around 3 mil small (and micro) businesses in Australia and somewhere in vicinity of 40,000 bookkeepers, that equates to around 75 per bookkeeper. It’s obvious that the great majority of small business operators are DIY when it comes to their own books. If we assume between 5 and 10 customers per bookkeeper, that means less than 10% of small business is using a bookkeeper. Which probably explains the high failure rate of small business. For sure many SMBs use financial software and that is despite a majority having no basic bookkeeping, accounting or financial software education.

The stakes are high for business when you consider that 1/11th of their sales potentially belong to the ATO. Similarly, 1/11th of their expenditure may be a tax credit. Many BAS agents would tell you that the DIY returns are riddled with errors, even though the GST system has been in for over 12 years.

There is a deeper issue; that business is self-tracking its own performance and maybe making the wrong business moves. The potential for the industry is massive. The opportunity for rocks-star bookkeepers to emerge remains nascent.

A glass ceiling to income

Despite the vast opportunity to build a client base and to run a highly profitable practice (as demonstrated by the Sageworks data) many bookkeepers set an artificial glass ceiling to their own revenue and income projections. Many are trapped in a cycle of skinny margins, doing basic data entry and compliance work.

Bookkeepers spend a lot of time with SMB owners and are in the front line on the important process of preparing financials. Bookkeepers are the gate-keepers who ensure the accounting process is built on firm foundations. It goes without saying that good bookkeeping makes life easier for accountants as well as the business clients.

Bookkeepers should identify what extra services they can provide to get their clients into better shape. And to join the rockstar set of bookkeepers.